In this post we will dive into the Trump Administration’s tariff strategy, and how tariffs may impact cabinetry costs. This is a snapshot in time and is likely to change.

We will refer extensively to a presentation made at the Kitchen Cabinets Manufacturers Association (KCMA) Spring Conference on April 10, 2025. The presenter was Luke Meisner, a partner at Schagrin Associates. Luke has been working with KCMA on trade issues for several years.

The Bottom Line: From what we know today, there will likely be some cost impact on cabinets. However, it should be minimal if the cabinet’s components are manufactured in North America, and even less if most of the components are manufactured in the US. The cabinet’s country of origin will likely have a substantial impact on costs, especially cabinets manufactured outside of North America.

Historical Cabinet Imports

Before we jump into the administration’s policies, let’s take a look at historical cabinet imports.

The chart above demonstrates cabinet import revenue from China and the Rest Of the World (ROW). Imports have been $150-$200 million for the past several years. Starting in 2019 KCMA won important trade cases against some Chinese cabinet manufacturers for unfair trade practices. In some cases Chinese manufacturers received countervailing and anti-dumping penalties totaling as much as 251%. This drove manufacturing to other countries such as Vietnam, Canada, Mexico, Malaysia, Thailand and Cambodia, among others. Many Chinese manufacturers also established subsidiaries in these countries, and are using Chinese equipment and materials to make cabinets for export to the United States.

President Trump’s America First Trade Policy

Let’s start with the administrations’s end goal: Fortress North America. As much as possible, the administration wants the US to be self-reliant. This is aligned with national security goals discussed below.

There are three basic components to the administration’s trade policy when it comes to tariffs as applied to cabinets:

- Fentanyl-Immigration Tariffs

- Reciprocal Tariffs

- National Security (Section 232 Investigation)

Fentanyl-Immigration Tariffs

Under the International Emergency Economic Powers Act the administration imposed tariffs on Canada, Mexico and China to combat illegal immigration and high levels of fentanyl deaths in the US. Canada and Mexico have an additional 25% tariff effective April 2 on non-compliant goods. China was originally hit with a 10% tariff on all goods, which was doubled to 20%.

Imports from Mexico and Canada are exempt from the 25% tariffs if they are compliant with the US-Mexico-Canada Agreement (USMCA). To be compliant, the final product must have most of their content sourced from North America per the USMCA. Any cabinets made entirely of North American materials will be compliant.

Reciprocal Tariffs

On April 2, reciprocal tariffs were declared at a minimum of 10%. For countries that run trade surpluses, it was to be much more. For example, Vietnam (46%), Indonesia (32%) and the European Union (20%). On April 8, except for China, President Trump lowered all reciprocal tariffs to 10% for 90 days so trade deals could be negotiated.

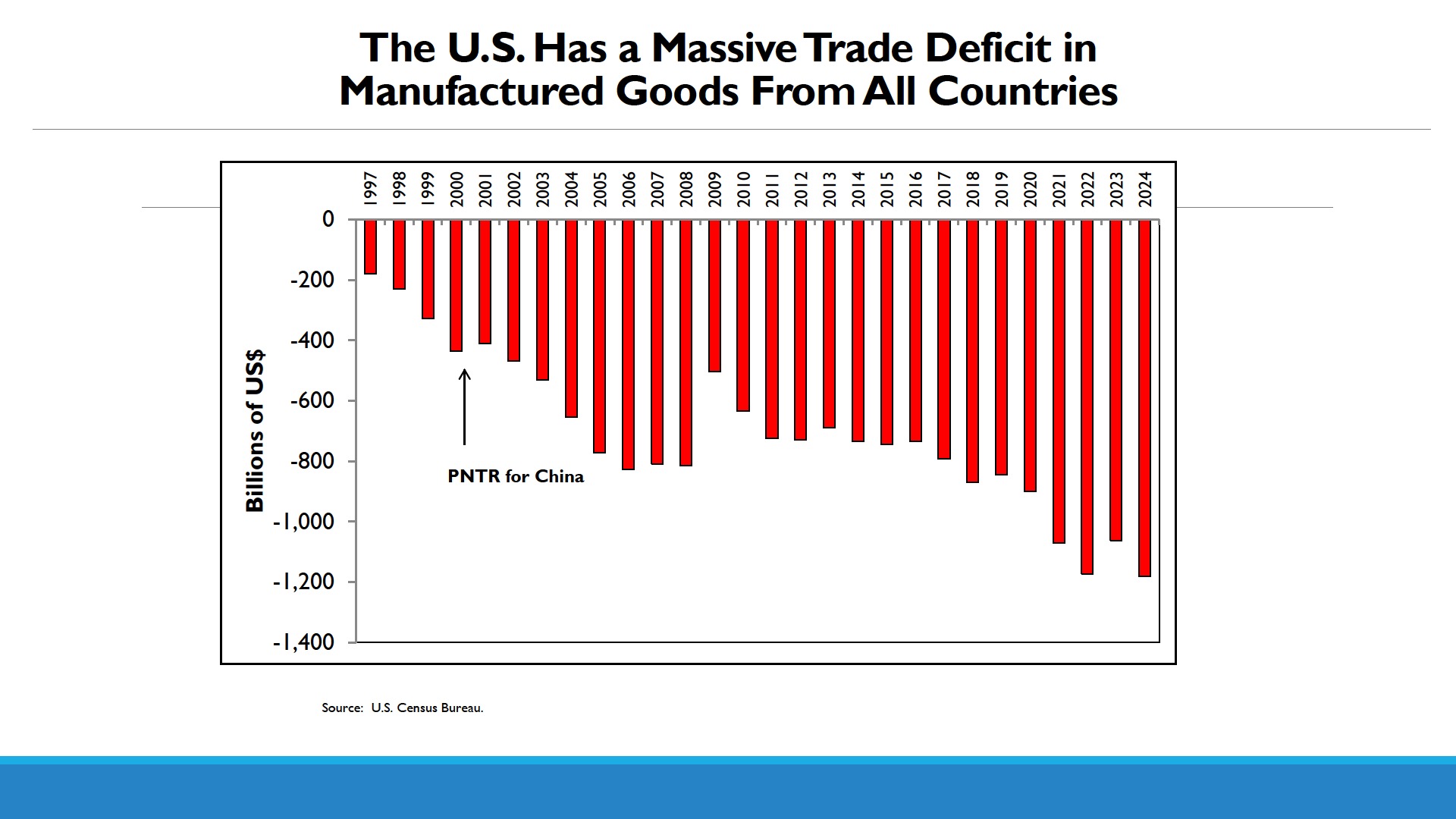

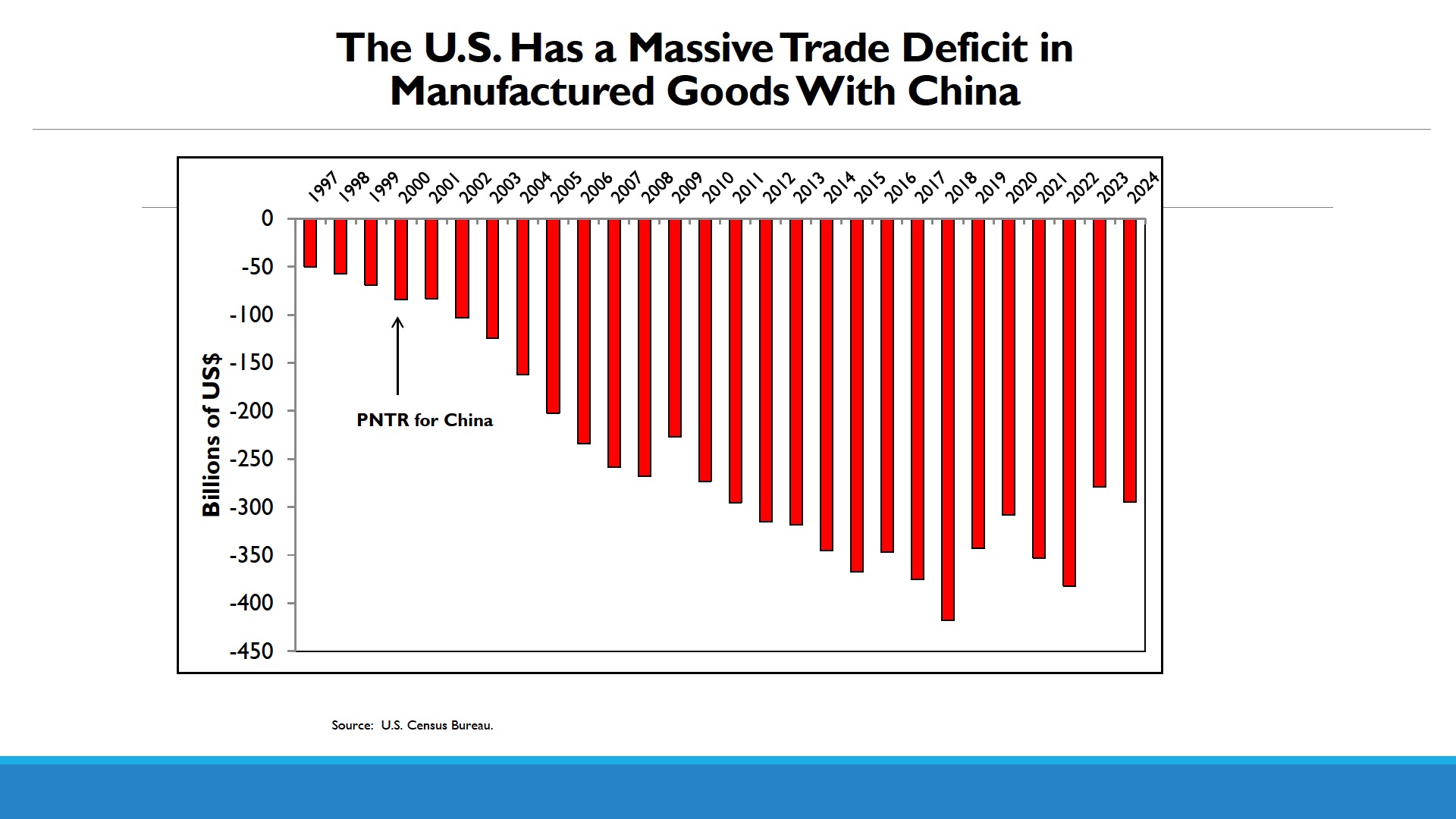

Driving the reciprocal tariffs are the large persistent annual US trade deficits. These deficits have ballooned from $200 billion in 1997 to $1.2 trillion in 2024.

China has been the biggest contributor to the trade deficit. However, other countries have also played a substantial role, specifically the EU, Mexico, Vietnam, Thailand, India and South Korea.

The continual increase in the trade deficit has led to several issues that the reciprocal tariffs are designed to address:

- Create new incentives to bring advanced manufacturing back to the US.

- Strengthen our supply chains.

- Make our defense industry less dependent on adversaries.

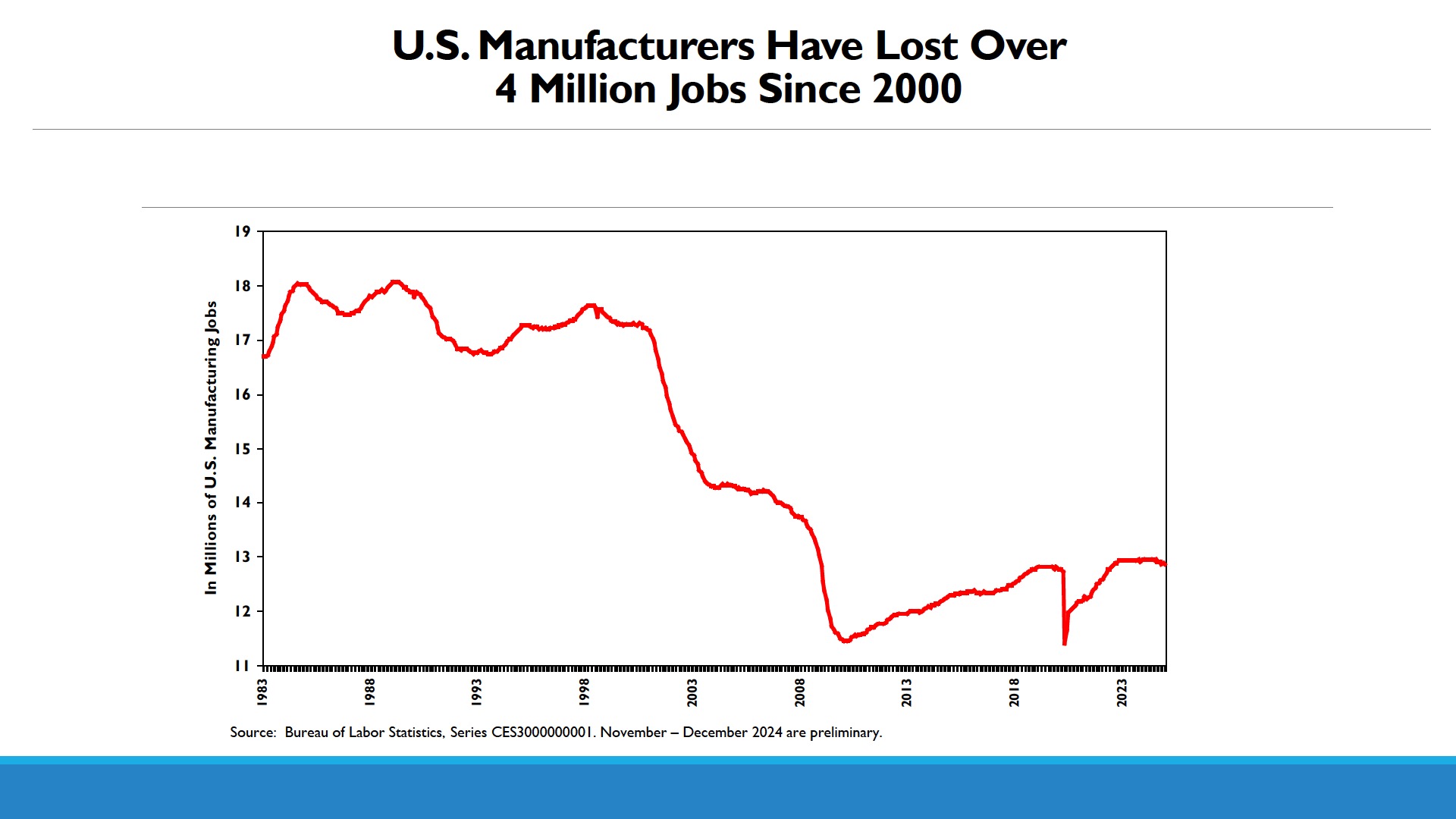

As the chart demonstrates below, our ability to “make things” has reduced dramatically the past 20 years. This creates serious issues concerning our ability to thrive as a country and to our national security.

National Security

This takes us to the third and perhaps the most important aspect of the administration’s tariff strategy. The US relies on other countries for key pharmaceuticals, military parts, technology components and many other critical items for our national security.

This is where the Section 232 investigation comes in, and may have a direct impact on cabinets. On March 1, 2025, President Trump launched an investigation into how imports of timber, lumber, and their derivative products threaten America’s national security and economic stability. The Executive Order specifically mentions “derivative products like paper, furniture, and cabinetry.” Yes, cabinets could get caught up in tariffs designed to make the US more secure. Explained below are the anticipated impacts on cabinets, but these are the issues driving this security investigation:

- Home Building. Over 90% of new homes are wood-framed.

- Paper and Packaging. Paper-based products range from communication paper to hygiene goods.

- Logistics. Boxes, pallets, etc. essential for nearly all goods.

- Defense and Military Infrastructure. The U.S. military relies on wood products for building bases, barracks, etc.

- Energy Independence. Renewable biomass materials used for bioenergy and biofuels.

What could this mean for cabinet costs?

This was the burning question for all of us at the KCMA Spring Conference. No one really knows. However, Luke anticipates that all lumber will be subject to some level of tariffs, as it is critical to national security. And, as cabinets are a derivative of wood products, they will likely be hit with similar or the same tariffs. So, certain imported lumber species will go up. However, so will any cabinets imported. Least affected will be cabinets made in North America that comply with USMCA.

At Bishop Cabinets we source most of our materials from domestic suppliers. We have recently recieved increases from some suppliers, and are hearing from others about potential increases in the near future. We believe part of this is the uncertainty in the market, and in some cases where costs have truly increased, i.e. the 10% reciprocal tariff or just standard inflation and market supply. We are watching this closely. As always, we will make every attempt to avoid a price increase by first looking internally at any efficiencies we can gain to offset cost increases. If we do have to increase prices, we will provide a 45-day notice.

About Bishop Cabinets

Bishop Cabinets has been manufacturing for over 60 years. Click here to learn more about our capabilities and latest offerings that align with the latest trends in cabinet finishes.

Our Vision Statement

“To create beautiful and functional cabinets through innovation, growth, and a commitment to keep family values at the core of everything we do.”